“There are no good multifamily deals out there!” Have you ever heard this…or maybe said it yourself?

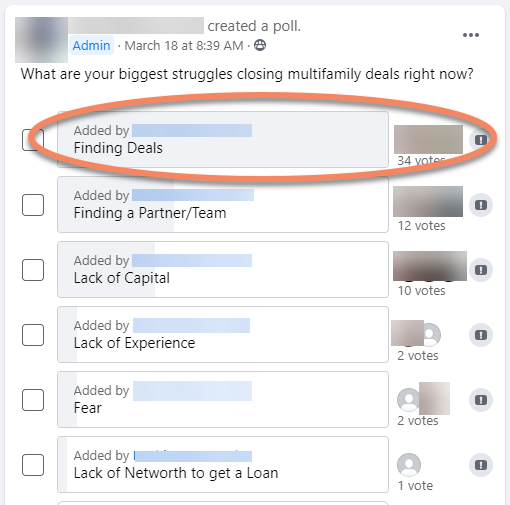

If so, you’re not alone. The other day someone asked on Facebook what everyone’s biggest struggle is with closing multifamily deals. Here are the results:

The #1 thing most investors said they’re struggling with is finding deals.

If that’s the boat you’re in, you’re in luck. We’re going to dive in to the best ways to find multifamily deals.

The most common way to get a great deal is to have good brokers in your back pocket. There are other options we’ll cover as well, but I would be remiss if we didn’t cover brokers in an article about finding great deals!

Finding Brokers to Work With

It can be difficult to find good deals on multifamily properties in Class B and C categories in larger metropolitan areas, especially when you’re first starting out. The reason is because many of these deals are passed through networking and referrals and never make it to the public listing where Newbie Joe gets to see them. The people who have good relationships with the broker are the ones who get first dibs on those deals.

Real estate brokers list multifamily properties and put them into MLS sites that anyone can view. That can mean those listings are more competitive and overpriced.

The top commercial MLS service is LoopNet.com. Other MLS services that list CRE properties are Showcase, ApartmentBuildings.com and CREXi.

If you’re looking for something specific in an area that a lot of other investors aren’t watching, you can even find a good on-market deal. Plus, it can give you a feel for how much things are going for in the area where you want to invest.

However, these sites are generally more helpful for finding brokers than deals. Those brokers can lead you to the good deals. Just make note of a few brokers that have properties similar to what you might be interested in. Give those brokers a call to say, ‘I’m not interested in any of your current listings, but I’m looking for properties that meet these specifications (price, location, units, class, etc).’

Don’t expect to get the perfect deal after contacting one broker. It takes persistence and patience. But at the same time, you never know which broker will bring you a great deal. It could be Broker #1, or Broker #100. So take each contact seriously. Don’t just “wing it”. Plan out what you want to say because the words you choose can make the difference between whether you’re taken seriously or not, and whether this broker will send you any deals.

Not sure what to say? Grab the “How to Find Deals Resource Kit” below, which includes a sample script for talking to brokers. And in our interview with Jonathan Twombly, he reveals some awesome tips for working with brokers as well.

The elevator to success is out of order. You’ll have to use the stairs… one step at a time.

Once you’ve established contact with a broker and they start sending you deals, make sure you respond to their emails and calls promptly. Following up with a broker is the key to finding great deals. If they send you something that you dislike, then let them know why. This will save both of you time and build a relationship that could lead to many great deals down the road. If you don’t respond or don’t say why you’re not interested in a deal, you’re likely to miss out on the best deals because they’ll only share them with buyers who are serious and know what they want.

Video Interview: How to Find Multifamily Deals and Talk to Brokers with Jonathan Twombly

How To Find Multifamily Deals

Resources to help you find the best deals while making a great impression with brokers along the way.

Other People Who May Know of Off-Market Deals

Besides brokers, you’ll also benefit from a network of other people who have some sort of dealings with multifamily properties. You never know where your next deal may come from. It could be the property manager who knows an owner of one of the properties they manage is thinking of selling, or the contractor who does maintenance at a property that’s being neglected and has a lot of vacancies.

You can meet these people at real estate meetups, conferences and workshops. Meetup.com meetings and associations like the National Association of Realtors often hold meetings focused on real estate topics of interest.

People you’ll want to meet and build relationships with are realtors, brokers, contractors, insurance agents, real estate attorneys, and property managers.

Take advantage of seminars, workshops, meetups, conferences, and even webinars to connect with these individuals. We have some events listed on our multifamily investor upcoming events page.

What are some other ways to find off-market multifamily deals?

Contact Owners Directly

Some multifamily investors have found deals by directly contacting owners who didn’t have their property listed for sale. When a property owner has been thinking about selling their property but hasn’t yet contacted a broker, you can make a deal with them directly. If you can get to them first, it will not only give you an opportunity to get a great deal, but will save everyone money since no broker is involved.

In other cases, maybe the owner hadn’t been thinking about selling, but when you contact them and ask if they’d be willing to sell, it plants the seed in their mind, and in time they may be willing to sell.

Your basic options are to send some direct mail (a letter, postcard, etc.) or to call them on the phone.

Cold calling scares many investors because of its direct nature, but it can be an effective strategy in securing great multifamily deals. Just be prepared to hear “no” a lot. It doesn’t mean you’re doing something wrong. It’s a numbers game.

There are a couple benefits of calling over mailing. For one, you get immediate feedback. When you mail something, you have no idea if the intended recipient even saw it. With a phone call, you know who you’re talking to. If they’re willing to talk a little, you may even get some insight into the situation and realize that, no, they’re not ready to sell right now, but in six months they may be.

Another benefit of calling is that it’s essentially free. Direct mail can get pretty expensive before you get any results. A phone call mainly costs your time. You could have an assistant do a lot of the legwork and make sure you have the contact for the correct person, or perhaps even do the calling.

However, if cold calling is too uncomfortable for you, you could try direct mail. You can send out mailings to owners of apartment complexes. This can get you deals, but expect a low response rate. It’s usually something that has to be done repeatedly over a long period of time to see results. The cost can add up. But if you stick with it and are selective in who you mail, deals can and do come from this approach.

One way to contact owners is to look up rental ads on Zillow, Craigslist, Apartment.com, or in newspapers. Remember, an empty apartment unit means that the owner is losing money. This may be an ideal time to ask them if they’re willing to sell the property. Often, the listings you see online will be posted by property management companies which are not the owners. To find the property owners, look up the property in public records. For instance, if the property is owned by an LLC, you can check the Better Business Bureau (BBB.org), Bizapedia.com, Manta.com, or Google to find owner names and contact information. LinkedIn is also a great way to find owners.

Driving for Dollars

If you’ve done any single-family investing, “driving for dollars” may be a familiar phrase. But it’s sometimes overlooked with multifamily properties.

The idea here is to drive through areas where you’d be interested in buying a multifamily property (or hire someone else to), and physically look at properties that have potential. These are usually not listed for sale, but by seeing them, you will realize if there are signs of neglect or vacancies. That could be a good indication that the property has become a burden to the owner and that they might be willing to sell.

You could look up addresses of all the apartment complexes in an area and map them out. A handy tool for this is Google Maps. There is a feature under My Places where you can create your own map. This allows you to put pins on specific points on the map you want to visit (with labels and other details). This can be helpful in seeing where the apartments are in relation to one another, and will help you plan your route.

A few things to look for:

- Neglected landscaping

- Poor outdoor maintenance

- Litter

- Tall grass

- Swimming pool out of service or dirty during summer months

- Other neglected amenities

- Vacancy signs

- Potholes in roads / parking lot

Be sure to take good notes, and snap some photos if possible. If you go at times when most people are at work (between 10AM and 3PM on weekdays), you’ll be less likely to be noticed by residents.

Once you identify some properties that you’d be interested in, you can contact owners using the methods above (phone or letter).

While you don’t want to become a nuisance, being persistent can pay off. The first time you contact an owner, maybe it hadn’t crossed their mind to sell. But by asking about it, you’ve planted the seed. If you call back in a couple months, they may have been thinking more about it and may be more inclined to discuss it more.

Thought Leadership Platforms

Having your own podcast, YouTube channel, local Meetup group, etc. are often done primarily to attract investors, but it can also help you find multifamily property deals. On these platforms, you’re presented as the expert because you’re the organizer or leader. If you make it known on these platforms that you’re looking for deals or willing to partner on deals, a person who consumes your content could bring a deal to you.

It all goes back to the fact that people want to do business with people they know and trust. When you’re putting out valuable content, you’re seen as a thought leader or expert, which builds your credibility and makes it easier for people to want to work with you. If someone finds a good deal but doesn’t feel confident they can execute it, but they see you as someone experienced who can get the deal done, they could approach you to see if you’d be willing to partner – especially if you make it known that it’s something you’re open to on your podcast, etc.

For more information about building your own thought leadership platform, see our article called “Build Authority as a Multifamily Syndicator to Attract Passive Investors”.

Many syndicators have also been successful by teaching others how to invest actively in multifamily properties. This gives them the option to partner with their students on future deals.

By partnering with your students on their first deal, they benefit from your experience and credibility, and you benefit because they’re bringing deals to you. If you haven’t yet done your first deal or are still a beginner, you can also partner with an experienced investor. He’ll have a large network of brokers and contacts already that you can benefit from. And with a good mentor, the experience you’ll gain will be invaluable.

Get Brokers and Investors to Take You Seriously

If you’re contacting brokers to get off-market deals, they’re going to check you out to see if you’re legit. When they search on Google for your business, what comes up?

If you don’t yet have a top-notch multifamily website, we’d love to help you. You can have your website up and running faster than you’d think possible. This will give you the credibility you need and help you stand out from wanna-be’s, which makes it easier for brokers and other real estate professionals to take you seriously.

Check out our website demo here.

How To Find Multifamily Deals

Resources to help you find the best deals while making a great impression with brokers along the way.